Grove on Gladstell

Gladstell, Conroe, Texas

- 52

- 1972

- Class B

- 15-16%

- 3.7 MM

- 7%

- 2X

- 8%

- Low/Moderate

Grove on Gladstell-Texas

The Grove on Gladstell boasts an exceptional location in Conroe, Texas, just north of the Houston MSA. The property is strategically situated between two main corridors, providing convenient access to major highways and essential services. Additionally, it is directly across the street from an elementary school, making it an ideal choice for families.

Built in 1972, the property consists of 52 units averaging 1,016 square feet, offering one and two-bedroom floorplans. Notably, 80% of the units are spacious two-bedrooms, with 18 loft-style units that can function as a third bedroom or second family room. The interiors have been previously updated, and low-impact exterior renovations will enhance street appeal, increasing rents. Planned additions of a dog park and carports will further enhance the property’s appeal. Currently, the property enjoys a 90% occupancy rate, supported by strong submarket occupancy rates at 94% (Yardi).

Top 5 Reasons To Invest

Low-Impact Value-Add Renovations: Enhance property appeal and increase rental income through tenant-friendly improvements like a new dog run, BBQ area and carports, without the need for tenant evictions or occupancy disruptions.

Housing Shortage: Many Us markets, including greater Houston and Conroe area, desperate for affordable rental options.

Location, Location, Location: Conroe, Texas, is a prime location for multifamily investment due to its proximity to Houston, strong job growth, and affordable cost of living. The city’s expanding healthcare, manufacturing, and energy sectors are driving rental demand. Additionally, Conroe offers excellent schools, diverse recreational opportunities, and a high quality of life, attracting families and professionals.

Equity on the buy: Purchasing at over $900,000 less than the current Montgomery Appraised Value of $5,617,508.

Property Tax Reduction: Distressed owners allow us to purchase this property at a significant discount from County Appraised Value and in turn reduce our largest expense item at reassessment producing immediate cashflow improvements.

INVESTMENT HIGHLIGHTS

Why Texas?

The growth of these areas has transformed Texas from a largely agricultural and commodities-producing state into a highly urbanized and economically sophisticated place.

Why Houston?

The multifamily sector has benefitted from Houston’s tremendous population and job growth. Despite economic headwinds, the Houston labor market remains relatively strong.

WHY MONTGOMERY COUNTY?

Midfield provides two distinct acquisition strategies enhancing investors flexibility and diversification, optimizing returns while managing risk.

Proven track record of extensive expertise in strategic planning, project management, and construction oversight”.

Supported by talent and business vision

Evan McLeish

Pavel Portelles

Mike Desrosiers

Arlett Tygesen

Dave Mastronaldi

NEXT STEPS

This offering is only to open to ACCREDITED INVESTORS

Discover & Engage

Evaluate & Commit

Invest & Confirm

Update & Grow

IMPORTANT FAQS

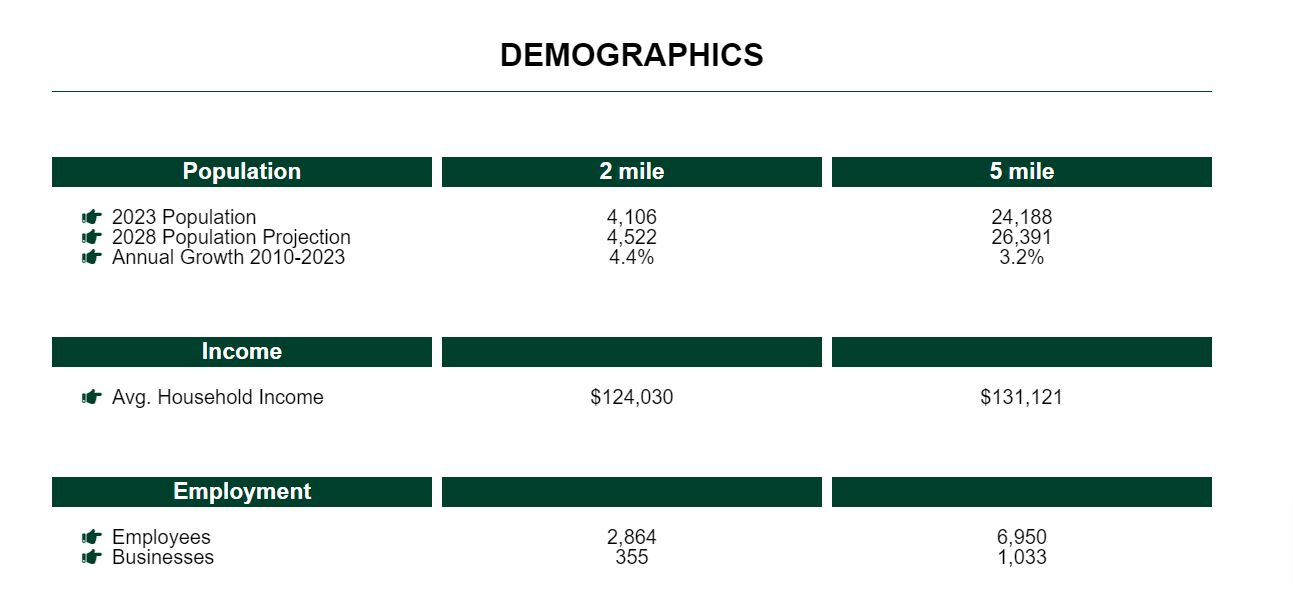

Conroe, Texas, is an increasingly attractive location for multifamily property investments due to its robust economic growth, strategic location, and strong population growth. Situated just north of Houston, Conroe benefits from its proximity to a major metropolitan area while maintaining a more affordable cost of living. The city is experiencing a surge in job creation, particularly in the healthcare, manufacturing, and energy sectors, driving demand for quality rental housing. Additionally, Conroe's excellent school districts, diverse recreational opportunities, and overall quality of life make it an appealing choice for families and professionals, ensuring a stable and growing tenant base.

To participate in our multifamily deals, investors must meet the Accredited Investor criteria, which generally include having a net worth of at least $1 million, excluding the value of the primary residence, or an annual individual income of more than $200,000 (or $300,000 jointly with a spouse) for the last two years, or net financial assets above $5 million.

The Minimum Investment is 50,000 CAD.

We distribute returns to investors on a quarterly basis, contingent upon the performance of the asset and meeting certain financial thresholds. During the value-add phase, reinvestment of the proceeds is prioritized to enhance the property, which aligns with our efficient approach to maximize returns.

Investors will receive regular updates via email newsletters, secure online portals, and periodic reports, with the specifics detailed in our communication plan.