Rental Housing Shortage

Limited new construction supports pricing power for existing assets as well as future acquisitions

Higher material and labor costs: Cost to build rental housing is generally 30-50% more expensive to build.

Higher financing costs and less availability: high interest rate environment and treasuries at 20-year highs combined with muted deal activity (52% year-over) make development even less feasible, bank lending historically supported roughly 30% of their financing programs via construction loans.

Structural demand drivers outpace elevated near-term supply:

- Rental housing undersupply of 4 million homes since

the Global Financial Crisis; with greatest concentration

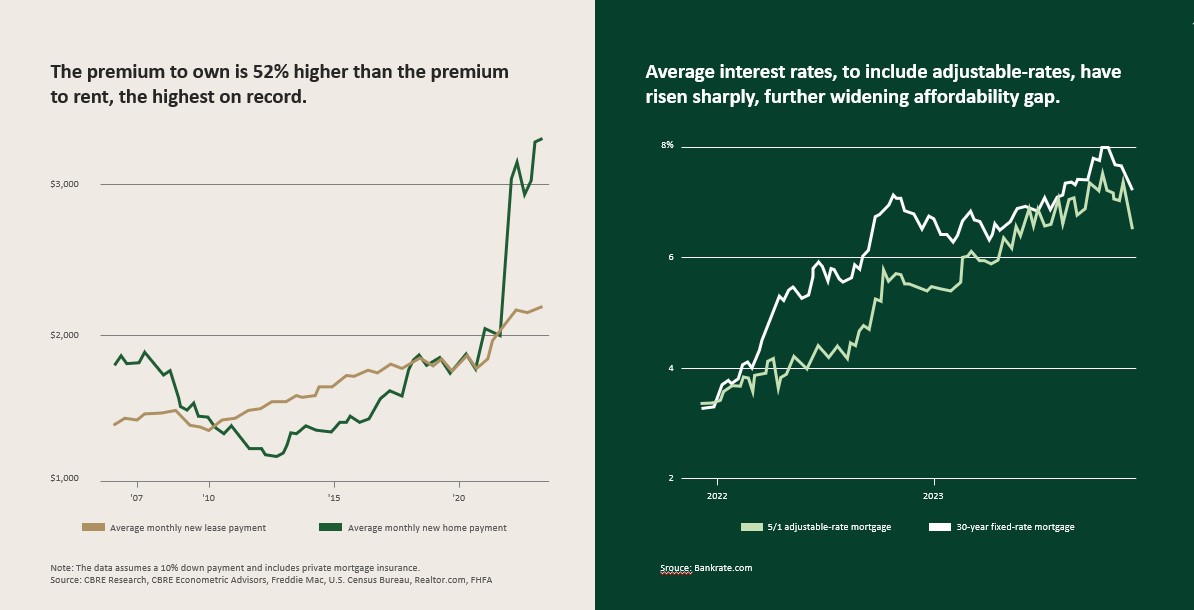

in the southeast, which has experienced 8x growth vs. the greater U.S. - Homeownership Affordability: owning a home is at its greatest premium, on history and ownership is even more

out of reach to a cohort of a population that more closely aligns with renting as a lifestyle preference

Affordability Crisis

Opportune Timing

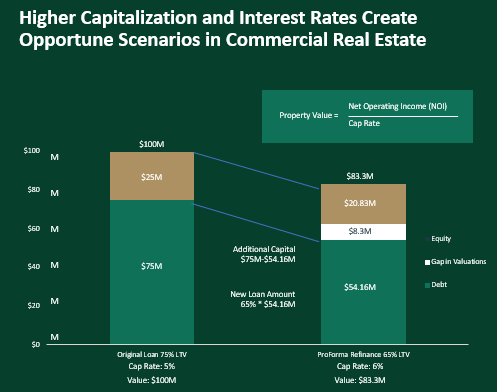

Even when net operating income remains constant, higher cap rates erode property values. Based on a disjointed equity and debt market,

an opportunity lies herein to reposition at a below “market” basis, with a strategic capital stack.

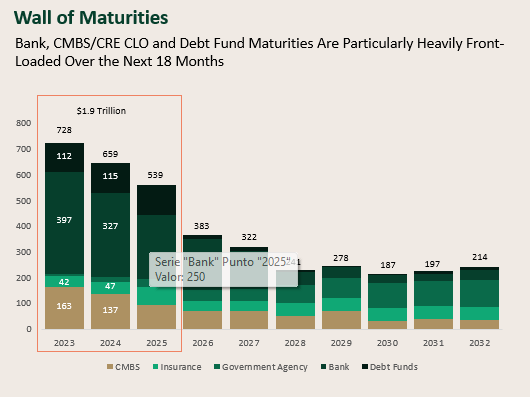

$626B of the loans maturing 2025 and before are “potentially troubled”. In a scarcer credit environment, debt originations are down 52% in

1H 2023, compared to the prior year and 31% compared to before

the pandemic.