Approach

Value-add/Opportunistic Model

Objective: Acquire distressed, undermanaged, well-located assets with substantial rent upside potential.

Key Components:

Refined Renovation Program: Develop a detailed and well-thought-out renovation program to enhance the asset and increase rent.

Management Focus: Unlock potential of the asset in terms of raising income and lowering expense burden through focused asset management and overall operational efficiency.

Core-Plus/Stable Growth Model

Objective: Focuses on higher-grade, Class A or B, stabilized assets at a potential discount.

Key Components:

Financing: Utilizes moderate, permanent financing to secure the investment for the long term. Seek financing structures that align with the stable and predictable cash flows generated by stabilized assets.

Asset Management: Emphasizes focused asset management to enhance the performance of the properties. Looks for opportunities to optimize operational efficiencies, potentially increasing net operating income (NOI) and overall property value.

Midfields Focus

Operational Excellence

Streamlined management processes and cost-saving measures, ability to maximize efficiency and profitability over our competitors.

Value-centric Focus

Midfield prioritizes investments showcasing value-add and long-term cash flow growth potential. Their approach involves meticulous analysis of financial statements, market trends, and competitive landscapes.

Agility

Addressing the current market demand as well as being highly responsive to market trends, Midfield focuses on outsized growth potential in nuanced target markets by keeping a pulse on ever-evolving market conditions and dynamics.

Rental Housing Shortage

Limited new construction supports pricing power for existing assets as well as future acquisitions

Higher material and labor costs: Cost to build rental housing is generally 30-50% more expensive to build.

Higher financing costs and less availability: high interest rate environment and treasuries at 20-year highs combined with muted deal activity (52% year-over) make development even less feasible, bank lending historically supported roughly 30% of their financing programs via construction loans.

Structural demand drivers outpace elevated near-term supply:

- Rental housing undersupply of 4 million homes since

the Global Financial Crisis; with greatest concentration

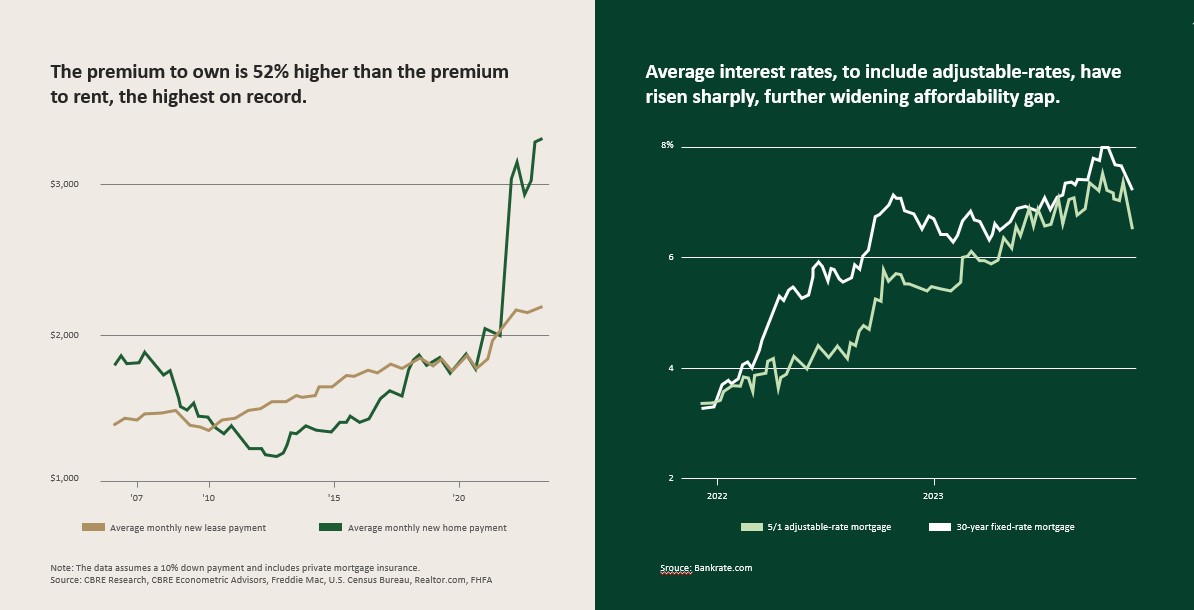

in the southeast, which has experienced 8x growth vs. the greater U.S. - Homeownership Affordability: owning a home is at its greatest premium, on history and ownership is even more

out of reach to a cohort of a population that more closely aligns with renting as a lifestyle preference

Affordability Crisis

Opportune Timing

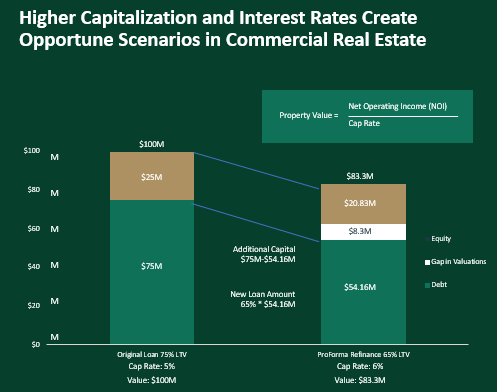

Even when net operating income remains constant, higher cap rates erode property values. Based on a disjointed equity and debt market,

an opportunity lies herein to reposition at a below “market” basis, with a strategic capital stack.

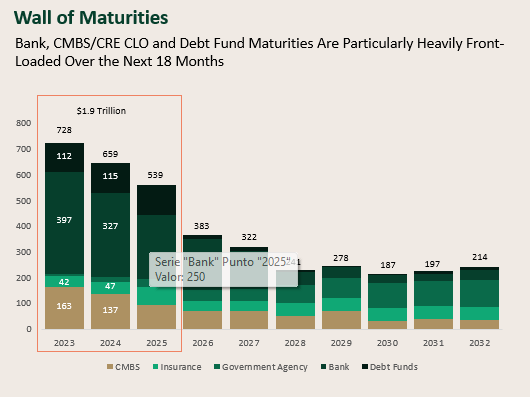

$626B of the loans maturing 2025 and before are “potentially troubled”. In a scarcer credit environment, debt originations are down 52% in

1H 2023, compared to the prior year and 31% compared to before

the pandemic.